|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

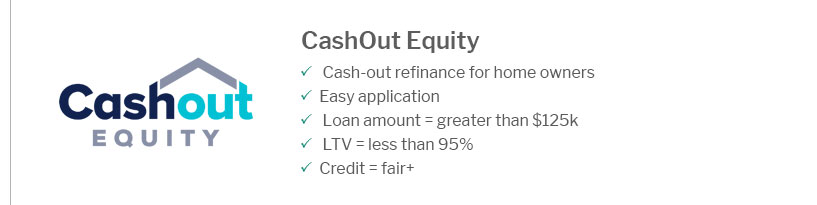

When to Refinance a House: Key Considerations and TimingUnderstanding RefinancingRefinancing a house involves replacing your existing mortgage with a new one, often to secure better terms. The process can help you save money, reduce monthly payments, or change loan types. Ideal Times to RefinanceFavorable Interest RatesOne of the most compelling reasons to refinance is when interest rates drop. Securing a lower rate can significantly reduce your monthly payments and total interest paid over the life of the loan. Improved Credit ScoreIf your credit score has improved since you took out your original mortgage, you might qualify for better rates and terms. This can be a perfect time to refinance. Loan Term ChangesConsider refinancing to adjust the length of your loan. Switching from a 30-year to a 15-year mortgage can save money on interest, while extending your loan term may lower monthly payments. Refinancing to Access EquityRefinancing can be a way to access your home’s equity for major expenses, like home improvements or paying off high-interest debt. However, it’s important to carefully weigh the costs and benefits. Costs Associated with RefinancingRefinancing isn’t free. Be prepared for closing costs, which can include appraisal fees, origination fees, and other charges. It's crucial to calculate whether the long-term savings outweigh these costs. Special Considerations for ARM LoansAdjustable-rate mortgage (ARM) holders might consider refinancing into a fixed-rate mortgage, especially if their rate is about to adjust higher. Use resources like the should i refinance my arm mortgage tool to explore your options. Using Calculators for Decision MakingTools like the should i refinance calculator mortgage can provide personalized insights based on your financial situation and goals. FAQs

https://finance.yahoo.com/personal-finance/mortgages/article/when-to-refinance-mortgage-211721100.html

When property values increase, or you've been in your home long enough to gain some equity, it can be a good time to refinance. A cash-out ... https://myhome.freddiemac.com/blog/refinancing/when-right-time-refinance

When to Consider Refinancing - Mortgage rates are lower than when you closed on your current mortgage. Locking in a lower interest rate will lower your monthly ... https://www.discover.com/home-loans/articles/what-does-it-mean-to-refinance-a-house/

A refinance is when you get a new mortgage to pay off the balance of your existing mortgage. When used correctly, a refinance may save you money ...

|

|---|